Is Gold a Good Investment?

Gold makes sense for those who have no access to or no trust in the financial system. Or expect to be in such a situation. It’s an alternate currency. So, for those people, gold is a good investment.

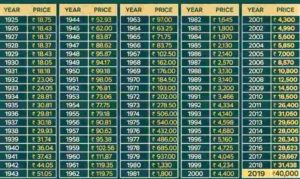

Firstly, if we look at the prices of gold that has increased from ₹18.75 in 1925 to ₹ 40,000 in 2019 for 10 grams. If the returns of investment in gold are is so good then why we should not invest in it?

Here is the interesting thing to look, if we calculate to find out the rate of return that has increased from the last 95 years i.e. from 1925 to present. It has only stood close to 8%. Now this 8% will not look this attractive as it as looking from the value through compounding effect.

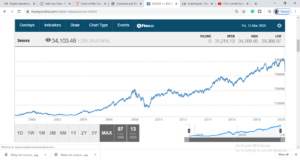

Secondly, let us talk about Nifty returns. From 2007, the market has only doubled compared to the huge amount of gold actually at present is.

Get 7.5 Hrs. Free Certification Course on Fundamental of Stock Market

Warren Buffet says ‘Gold is only for losers’

Whenever the economy is at its lowest, gold is more in the economy. Like in 2007, when the economy was hit, the market crashed, the people or rather investors would have thought of investing in gold is a safer option. The currency was volatile at that time, so people invested in gold due to which prices of gold went up.

When there is a war, there is an inclination towards gold. At the time of Brexit, people did not want to invest in pounds, so investment in gold did rise.

From this, we come to know that, whenever the public wants to park its money, they choose the option of parking their money in gold to be at a safer side when the future is uncertain because at the time of uncertainty gold is a good investment option.

Also Read: Why this is the best time for investment

Gold is not an investment. It is neither a bad nor a good investment. This is, in fact, a currency which people use to park money in. For example, if a person parks his money in dollars, he will not say this is a good investment or a bad investment. Instead, he will just say that he has parked the money.

But on the other side, the return from gold has risen since 2007. So, the question stands, why should we not invest in Gold?

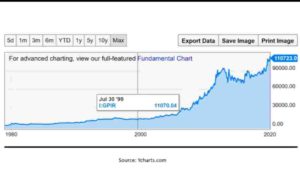

Here is an interesting observation. As we are talking about the period from 1925 to the present time, let’s take the favourable time period in this stretch where the return from gold is better. If you look at the figure below, you will see that in 1999, before the 2000 dot com bubble, the price for gold stood at ₹ 11070.04 for an ounce or 30 grams. Due to dot com bubble burst, people would have rather invested in gold.

In 2012, the price for gold rose to ₹ 93,000. In this period of 13 years, 1999 to 2012, if you take out the return on gold, then the CAGR will come to about 10%. Looking at the CAGR, the gold seems a viable option. So why should not you yet invest in gold?

This assumption can be taken for stock markets as well.

The base value of the stock stands at ₹ 100 in 1979. The market went on a peak in 1992, having a value of about ₹ 4200. The CAGR of this time period comes to 33%. So, it is possible from further on that Sensex is going to give returns of 33%. That may not happen as because from 1992 to 2001, there were no such returns because the market already gave the fruits in the beginning.

So, the interesting thing to note here is that it is not necessary that if the gold is giving better returns at a point of time, it will continue to do so. People might park their money in gold if there are chances of economic failure, war and fear in the market.

If you are betting on gold, you need to bet on the disaster of the economy as well. Then what should we look for, if not for favourable time periods for returns on gold?

Get 7.5 Hrs. Free Certification Course on Fundamental of Stock Market

Warren Buffet says ‘Investment is what, if as an owner, you can hold it for a lifetime and not sell it at all, you still will yield returns or earning out of it’. Like, you buy a building and never sell it but you get to rent out it or you buy a company and do not sell it, yet you continue to reap profits out of it. You buy farmland and not sell it but you get profits from the produce of the farmland.

It does not mean gold is a bad investment but there are better options than that. It can be a safe option to park your money in. Also, to compare gold with equity, it would be baseless. Equity is a productive asset whereas gold is a commodity which does not do anything by itself.

Also Read: Why this is the best time for investment

At last, remember Warren Buffet says “Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now. And if they become more afraid, you make money, if they become less afraid, you lose money, but the gold itself doesn’t produce anything”.

Special Thanks to Varun Malhotra.

Pingback: Best Investment Options - TheWiseMoney